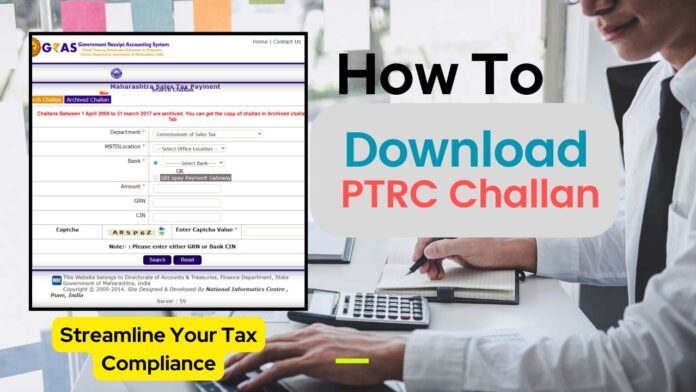

The PTRC (Professional Tax Registration Certificate) challan is a crucial document that serves as proof of payment for professional tax obligations in India. Whether you are an individual or a business, it is important to understand the process of downloading the PTRC challan to fulfill your tax responsibilities. In this step-by-step guide, we will walk you through the process of downloading the PTRC challan hassle-free.

Unlocking the PTRC Challan: A Step-by-Step Guide for Hassle-Free Downloads

Table of Contents

Time needed: 2 minutes

Download PTRC Challan Like a Pro: Your Comprehensive Step-by-Step Manual

- Identify Your State’s Official Website:

Each state in India has its own official website for professional tax-related matters. Start by identifying the official website designated for PTRC challan downloads in your state. You can usually find this information by searching online or contacting your state’s tax department. For Maharashtra Government Open https://mahagst.gov.in/

- Navigate to the PTRC Challan Section:

Once you have identified the official website, navigate to the section specifically dedicated to downloading the PTRC challan. Look for headings like “Downloads,” “Forms,” or “Challan” on the website’s main menu or sidebar.

- Locate the PTRC Challan Form:

Within the PTRC challan section, locate the PTRC challan form. It is typically available in PDF or other downloadable formats. Click on the link or button to access the form.

- Provide Required Information:

On the PTRC challan form, you will be asked to provide various details. Fill in the necessary information accurately, including your name, address, PAN (Permanent Account Number), and any other required fields. Double-check the information for accuracy before proceeding.

- Select the Appropriate PTRC Challan:

Different PTRC challans may be available based on your professional tax category and the payment period. Ensure that you select the correct challan form that corresponds to your specific tax requirements.

- Generate the Challan:

After providing the necessary information and selecting the appropriate challan, click on the “Generate Challan” button or similar option. This action will create the PTRC challan based on the provided details.

- Review the Generated Challan:

Carefully review the details mentioned on the generated PTRC challan. Verify that your name, address, tax amount, and payment due date are correct. Make any necessary corrections if required.

- Download and Print the Challan:

Once you have reviewed and confirmed the accuracy of the generated challan, proceed to download it. Click on the “Download” or similar option to save the PTRC challan to your computer. After downloading, print a hard copy of the challan for your records.

- Make the Payment:

To fulfill your professional tax obligations, you need to make the payment mentioned on the PTRC challan. Visit an authorized bank or use the online payment facility specified by your state government. Follow the prescribed payment process and ensure that you pay the correct amount before the due date.

- Retain Proof of Payment:

After making the payment, it is crucial to retain proof of payment as evidence. Ensure that you receive a receipt or acknowledgement from the bank or online payment platform. This proof will serve as confirmation of your professional tax payment.

- Maintain Records:

Organize and maintain a record of PTRC challans and corresponding payment receipts for future reference. It is important to keep these documents safely as they may be required during tax audits or for any other administrative purposes.

Tips for Successful PTRC Challan Download

| Tips |

|---|

| Verify your information |

| Stay updated with changes |

| Keep copies of documents |

| Seek assistance if needed |

Document Checklist for PTRC Challan Download

| Required Information |

|---|

| Full Name |

| Address |

| PAN (Permanent Account Number) |

| Contact Details |

| Tax Category |

| Payment Period |

| Tax Identification Number (if applicable) |

Conclusion

Downloading the PTRC challan is a vital step in fulfilling your professional tax obligations in India. By following this step-by-step guide, you can easily navigate the process and ensure compliance. Remember to visit the official website designated for PTRC challan downloads in your state, gather the required information, select the appropriate challan form, and carefully review the generated challan before downloading and printing it.

It is crucial to make the payment on time and retain proof of payment for future reference. Stay updated with any changes or updates to the PTRC challan process by regularly visiting the official website. By following these guidelines and maintaining organized records, you can streamline your tax compliance and fulfill your professional tax responsibilities efficiently.

Always double-check the accuracy of your personal information and seek assistance from the state tax department helpline if needed. By staying informed and proactive, you can ensure a smooth PTRC challan download process and fulfill your professional tax obligations with ease.

Remember, the PTRC challan is an essential document, and adherence to the tax regulations is crucial. By downloading the challan promptly and making the necessary payments, you contribute to the growth and development of your state.

Disclaimer: The information provided in this article is for general guidance purposes only and may not reflect the most current regulations. It is advisable to consult with a qualified tax professional or visit the official website of your state’s tax department for the most accurate and up-to-date information.